| |

|

Top Story

|

|

ZILLOW

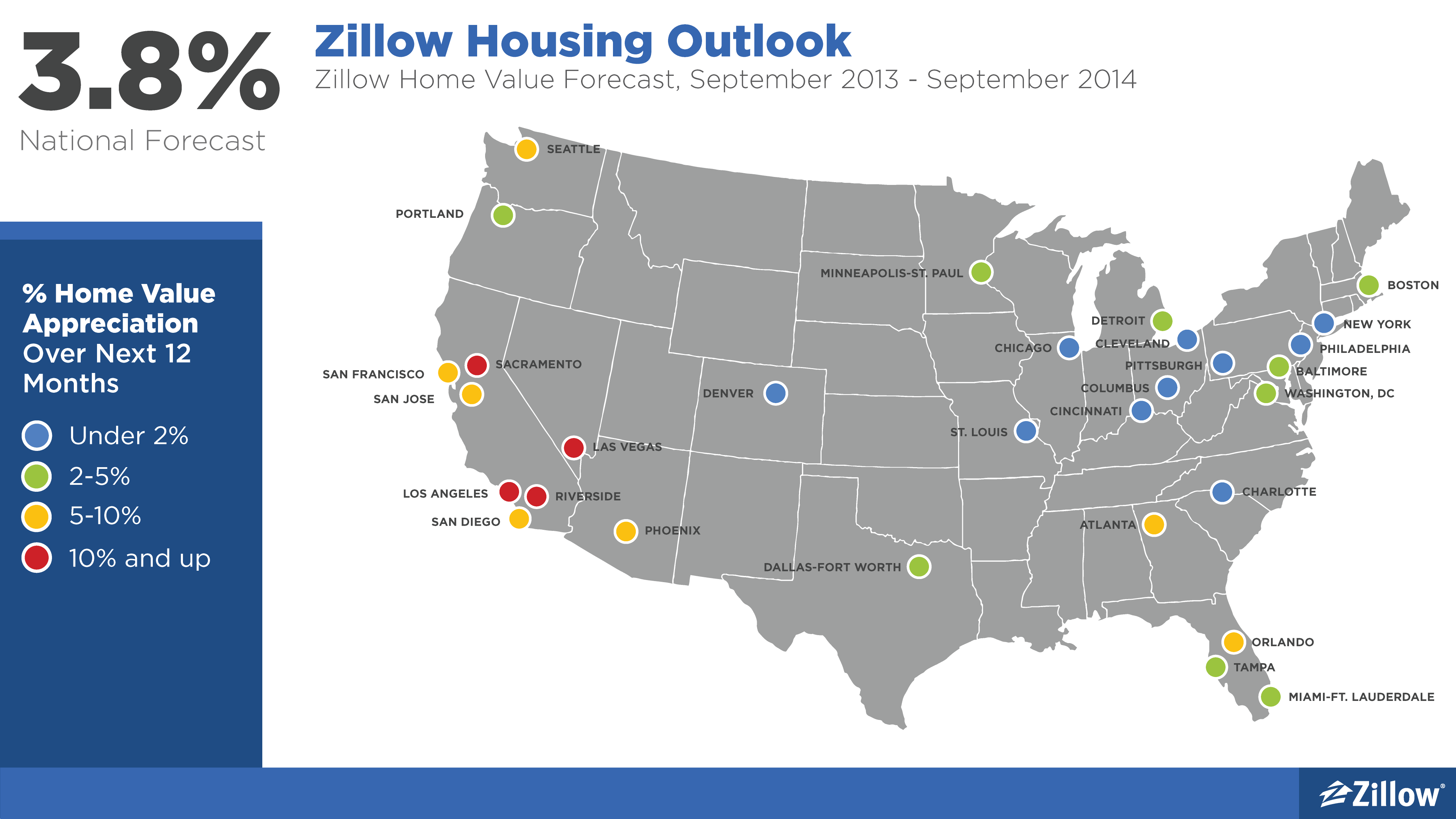

Zillow analyst Svenja Gudell posts the broad strokes and minutia in Zillow's third quarter Real Estate Market Reports. Gudell expects national home values to increase 3.8% over the next year (September 2013 to September 2014). Of the 252 markets covered by the Zillow Home Value Forecast, 223 markets are expected to see increases in home values over the next year, with the largest increases expected in the Riverside metro (23.9%) and the Sacramento metro (16.7%). Read More

|

Advertisement

|

Learn why Ram Commercial is calling it a comeback.

Visit the Ram Learning Exchange.

Learn More |

|

Business

|

|

SACRAMENTO BEE

Wooing buyers back into the market, lots of little amenities add up in homes that reflect the way we want to live now. Sacramento Bee reporter Debbie Arrington looks at the telling trends in selling homes. Read More

|

|

|

INMAN NEWS

Inman News contributor Bernice Ross looks ahead to the Jan. 1, 2014 effective date of a new provision in the Dodd-Frank Wall Street Reform and Consumer Protection Act: The "qualified residential mortgage."

Read More

|

|

|

FORBES

Forbes contributor Brian O'Connell looks at factors including interest rates and price trends, and concludes that the numbers tell a pretty compelling story to those who are on the fence about whether to buy a home now or wait. Read More

|

|

|

Advertisement

|

the ultimate playbook for student housing

LEARN MORE |

|

Companies and Brands

|

|

SHEA HOMES BLOG

For Shea Homes, building science can be an ingredient in sales and marketing alchemy. Here, a post on Shea Homes Arizona's "Cathedralized Attic" insulation is a case in point. Read More

|

|

|

RICHMOND AMERICAN HOMES HOMEWARD BLOG

The thought of moving can be a nightmare. Actually doing it doesn't need to be, and Richmond American Homes' Homeward blog hyperlinks five turnkey tips and resources from around the web to simplify the move into doable chunks. Read More

|

|

|

FAST COMPANY

Outthinker's Kaihan Krippendorff thinks the journey to a really strategic plan involves four steps. Here they are in a Fast Company column. Read More

|

|

|

Policy

|

|

NATIONAL MORTGAGE NEWS

The economic recovery faces a challenge in January when new mortgage rules threaten to derail credit to prospective borrowers with blemished credit, industry insiders warn. National Mortgage News' Amilda Dymi makes this case succinct and clear. Read More

|

|

|

FORBES

I's the uncertainty, stupid. Moody's Analytics chief economist Mark Zandi says Washington's continuing budget and debt wars are the biggest threat to economic growth. Forbes staffer Janet Novak has analysis. Read More

|

|

|

HOUSINGWIRE

HousingWire's Kerry Ann Panchuk reports that one in five mortgages originated do not meet the heightened legal protections under the qualified mortgage rule's safe harbor provision, according to a test trial conducted by ComplianceEase. Read More

|

|

|

Market Intelligence

|

|

CULTUREMAP AUSTIN

Last year, CultureMap Austin created a list of the next hipster cities. Here's this year's up-and-comers in that category. And who here does not think hipsters are the ones on a fast-track to buying a home, and contemplating buying all the next-door neighbors' homes as well? Read More

|

|

|

THE ATLANTIC

New York, Houston, Washington, D.C.-plus college towns and the energy belt-are all up, while much of the Sun Belt is (still) down. Atlantic contributor Richard Florida maps winners and losers since the crash. Read More

|

|

|

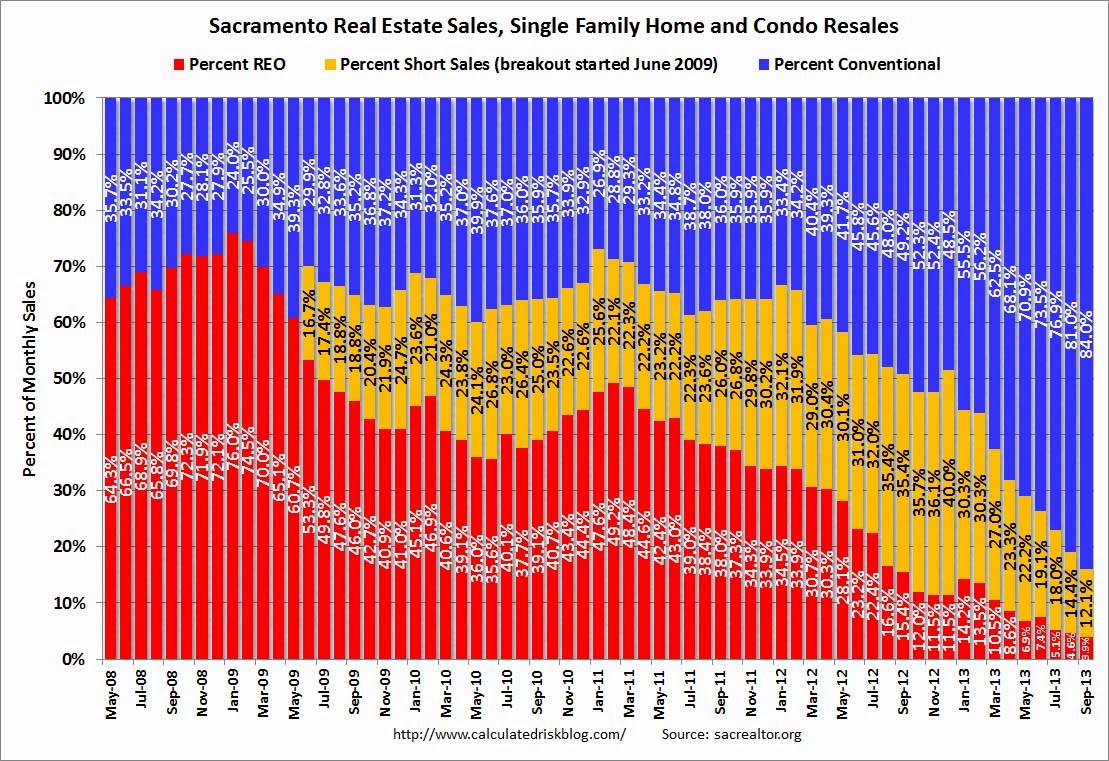

CALCULATED RISK

Calculated Risk's Bill McBride zeroes in on the Sacramento, Calif., housing market as a sort of proxy to what may be at work in variations in other places down the road. It's a story of healing housing. Read More

|

|

|

Finance and Economics

|

|

FEDERAL RESERVE BANK OF CLEVELAND

Cleveland Fed research economists Yuliya Demyanyk and Amy Higgins note in their analysis of household debt and housing trends that the Mortgage Bankers Association projects that home sales will grow from $503 billion in 2012 to $615 billion in 2013, about $700 billion in 2014, and $990 billion in 2015. Read More

|

|

|

FEDERAL RESERVE BANK OF SAN FRANCISCO

Federal Reserve policymakers are watching a broad set of indicators for signs of "substantial" labor market improvement, a key consideration for beginning to scale back asset purchases. One way to find which are most useful is to focus on how well movements in these indicators predict changes in the unemployment rate. San Francisco Fed research economists Mary C. Daly, Bart Hobijn, and Benjamin Bradshaw suggest that six indicators are most promising. Read More

|

|

|

BLOOMBERG/ BUSINESSWEEK

Bloomberg/ BusinessWeek's Prashant Gopal reports that U.S. mortgage rates climbed for a second week, increasing borrowing costs as Congress voted to end the government shutdown. Read More

|

|

|

Design and Trends

|

|

NAHB EYE ON HOUSING

National Association of Home Builders economist Natalia Siniavskaia looks at items that are most popular among home buyers, ones that explain changes in their spending behavior triggered by a house purchase. Read More

|

|

|

WALL STREET JOURNAL

Affluent home buyers attempting to get back into real estate after defaulting on their home loan are finding that few lenders are willing to work with them. MarketWatch's AnnaMaria Andriotis reports. Read More

|

|

|

PEW RESEARCH

In America, fathers, on average, have about three hours more leisure time per week than mothers. This "leisure gap" has been consistent at least over the past decade. Read More

|

|

|

Pulse Lines

|

|

REUTERS

U.S. jobless claims fell last week and mid-Atlantic factory activity kept growing in October, but a just-ended government shutdown as well as computer issues affecting the claims report impeded the data's value as signposts for the economy. Read More

|

|

|

REUTERS

The Federal Reserve may have to wait until early next year before it sees sufficient strength in the U.S. economy to begin scaling back its bond-buying stimulus, after a destructive Washington budget battle that may take a bite out of growth. Read More

|

|

|

LOS ANGELES TIMES

Home prices and sales fell last month in the Bay Area as the tech-rich region mirrored a cooling trend elsewhere within the state. Read More

|

|

|

|

|

|

|

Builder Pulse is a daily morning news briefing for the residential construction industry.

To make sure you continue to receive our e-mails in your inbox (not in your bulk or junk folders), please add the following to your address book or safe sender list: nwbd@bldr-media.com.

Click Here to Unsubscribe

© Hanley Wood, LLC. All Rights Reserved. Republication or re-dissemination of this newsletter's content is expressly prohibited without the written permission of Hanley Wood, LLC.

|