Wells Fargo Home Mortgage National Builder Division

Building TimesSM Bulletin

July 2015

IN THIS ISSUE

Setting expectations for TILA-RESPA

Sales centers go high tech

Digital access provides loan status clarity

Ideas to help build your business

Welcome to the Wells Fargo Building Times℠ Bulletin. This newsletter is filled with the latest industry news, tips, and strategies to inspire you and help you keep your business moving forward.

At Wells Fargo Home Mortgage, we’re always looking for ways to help you boost your business by keeping you up to speed on the latest marketplace trends. As part of that effort, we invite you to watch a replay of the June 15 webinar featuring NAHB Chief Economist David Crowe, who analyzed the latest results of the NAHB/Wells Fargo Housing Market Index (HMI).

To watch the webinar replay, go to: www.nahb.org/hmiwebinars.

Mark your calendars for the 2015 NAHB/Wells Fargo HMI Webinar dates:

- Thursday, September 17: 11 a.m. to 11:30 a.m. ET

- Tuesday, December 15: 11 a.m. to 11:30 a.m. ET

Your regional builder sales manager can provide you with registration information.

Wells Fargo is committed to actively supporting the new-construction industry and is dedicated to providing you with the tools, resources, and information you need to help you grow your business.

Full disclosure: Setting expectations for TILA-RESPA

Prepare for new disclosure rules by learning about the new rules and working with your mortgage consultant.

The documents your buyers see after they apply for a loan and at closing time are about to change for the first time in more than 30 years.

For decades, the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act of 1974 (RESPA) have required lenders to provide two separate forms to consumers applying for a mortgage and another two forms at closing time. The TILA-RESPA Integrated Disclosure rule (TILA-RESPA for short), which goes into effect with applications received on or after August 1, 2015, integrates these forms, making them more clear, concise, and consistent, so that borrowers can better understand the mortgage process.

Wells Fargo Home Mortgage is prepared to integrate these requirements, and you can be confident your buyers will enjoy an excellent experience when it’s time to buy their new home. Builders can help make that experience even smoother by learning about the new rules and help buyers avoid surprises by setting the right expectations.

Get to know the Loan Estimate and the Closing Disclosure

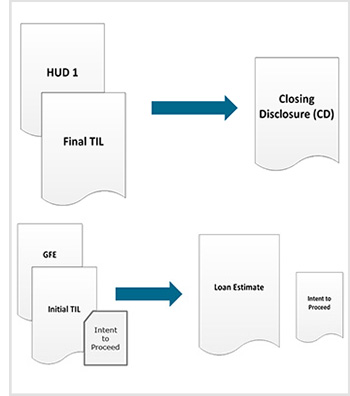

Beginning with new applications taken on or after August 1, 2015, TILA-RESPA mandates new disclosure forms for home purchase and refinance transactions (but not for home equity lines of credit). Instead of the initial Truth-in-Lending statement and Good Faith Estimate, borrowers will receive a new disclosure called the Loan Estimate (LE). And instead of the final Truth-in-Lending statement and HUD-1, borrowers will receive a Closing Disclosure (CD).

The two new disclosures were created by the Consumer Financial Protection Bureau after extensive consumer and industry research to protect borrowers and provide them with a clear summary of loan features, rates, and fees so they can make the best financial decision.

Prepare for a new look

The LE and CD have fresh layouts and include a few calculations that may stand out to your buyers. Both provide information about how much cash the borrower needs to close, a calculation that the initial Truth-in-Lending statement and Good Faith Estimate didn’t have. A “projected payments” section shows the estimated total monthly payment, similar to what a buyer would see on the current initial Truth-in-Lending document.

The new mortgage timing requirements

TILA-RESPA includes important timeline requirements that may impact the home buying process.

The lender must provide the LE to the borrower within three days of the loan application. After the borrower receives the LE, the lender must clearly document the borrower’s intent to proceed with the transaction. The lender can only collect fees, such as appraisal fees, after receiving this confirmation (a lender may still collect a bona fide credit report fee in advance of receiving the borrower’s intent to proceed).

Each consumer must receive the CD at least three business days before closing. If certain information in the CD is changed, the lender must provide a revised CD at the closing table. In certain circumstances, the three business-day review period has to be restarted.

- Change to the APR outside of tolerance

- Change in the loan product

- Addition of a pre-payment penalty (Wells Fargo does not charge pre-payment penalties on mortgages)

Understanding TILA-RESPA’s definitions of “provided” and “received” can help builders and their buyers avoid potential timeline surprises. Documents provided to the borrower can be:

- Delivered face to face.

- Placed in postal mail.

- Sent electronically.

Documents can be presumed received:

- When they are physically in the buyer’s possession.

- After three business days, if they’re sent in the mail or electronically.

- If the lender obtains evidence they were received before that three-day period.

That last option comes into play with a new time-saving option from Wells Fargo Home Mortgage: yourLoanTrackerSM can provide disclosures, and register the intent to proceed online. Read more about yourLoanTracker in “Digital access provides loan status clarity,” below.

That last option comes into play with a new time-saving option from Wells Fargo Home Mortgage: yourLoanTrackerSM can provide disclosures, and register the intent to proceed online. Read more about yourLoanTracker in “Digital access provides loan status clarity,” below.

Setting expectations

You can help your buyers avoid any surprises by educating them about the mortgage process, and your Wells Fargo home mortgage consultant (HMC) is ready to guide your borrowers through the mortgage process checklist.

There are a few other steps your sales agents can take to smooth the road to closing:

- Encourage your buyers to get preapproved, so your sales agents know they’re working with a ready-to-buy borrower.

- Collaborate with all involved parties when setting the closing date to ensure adequate time for the buyer to receive the CD.

- Discuss the option of electronic disclosures with your buyers.

- Encourage buyers to carefully consider their mortgage options upfront, and let them know how changes to the mortgage may affect the timeline.

- Minimize amendments to the purchase agreement after buyers have submitted their loan application.

- Remind buyers to refer to their most recent LE or CD to avoid surprises.

- Identify a settlement agent/attorney early in the process and work with our local home mortgage consultants to make sure the agent/attorney is approved by Wells Fargo.

Wells Fargo is here to help you and your sales agents navigate the new rules as TILA-RESPA goes into effect. By working with our HMCs, buyers are guided through a smooth and confident home purchase experience.

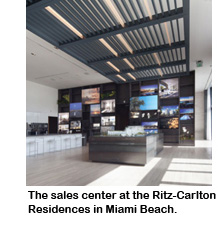

Sales centers go high tech

Immersive technology makes buyers feel right at home.

Walk into the sales gallery of the newly built Ritz-Carlton Residences in Miami Beach and you’ll see the uber-luxurious condo development’s half-acre, rooftop pool and deck, as well as its waterside lobby, looming overhead.

Walk into the sales gallery of the newly built Ritz-Carlton Residences in Miami Beach and you’ll see the uber-luxurious condo development’s half-acre, rooftop pool and deck, as well as its waterside lobby, looming overhead.

What you’re seeing is indeed part of this chic community, but the image isn’t real. It’s a hologram—actually, two of them—embedded into a 36-foot-wide, 15-foot-tall exhibition wall that also boasts videos, photos, and a diorama of the project, giving visitors a digital taste of what they’ll experience if they purchase a unit at the property. Behind it all, in a private screening room, designer Piero Lissoni narrates a video, articulating his vision for the building.

To be sure, the Ritz-Carlton’s towering holograms make a huge impression on buyers, but they’re not the only high-tech sales display in town. Take a short drive up the A1A, and you’ll come to the recently opened sales gallery at Oceana Bal Harbour, a 240-unit luxury condominium complex that features a larger-than-life, interactive scale model. Standing six feet tall, the 18-foot-wide model allows potential buyers to select and “light up” a specific unit in the building with a wireless remote. When they do, images of that unit’s floor plan and unique views instantly appear on the walls surrounding the model.

Welcome to the 21st-century real estate sales experience. While model homes, paper brochures, and take-home binders used to be the hallmark of new home sales, today’s sales tools are digitally dazzling, using displays of light and tactile, immersive experiences to give buyers a (virtual) feel for their new home.

And it’s not just a trend being rolled out by luxury condos on the coasts, either. Take the newly opened sales center at Bellmoore Park, a community of new, upscale single-family homes built by the Providence Group in Johns Creek, Georgia. There, touch-screen displays integrate with the community’s site plan, current inventory, and Google maps. The tool can be displayed on a kiosk, or can be used on a tablet while walking around the model or community.

The importance of the human element

The importance of the human element

What all of these sales centers have in common is a propensity to leverage technology to highlight, but not upstage, their communities. And the professionals who’ve designed the centers say that while a well-executed, immersive high-tech sales experience can help buyers reach for their checkbooks, the technology can’t build relationships.

At the Ritz-Carlton Residences, Miami Beach, for instance, Ophir Sternberg, CEO and founding partner of Lionheart Capital, the community’s developer, reports the holograms have been a huge hit with potential customers. “Customers feel more connected to a property when they can fully immerse themselves in the features of the sales gallery,” Sternberg says. “But the sales experience needs to be as humanizing as it is technologically advanced. Buyers want to interact with people as much as they want to interact with technology, and there are certain aspects of the sales gallery that simply cannot be replaced with a machine.”

For example, not only is the Ritz-Carlton Residences sales staff standing by to take potential buyers on a tour, but a personal, on-site butler is available to handle any request buyers might have. And for a taste of Miami Beach, a captained day yacht awaits outside, ready to chauffeur buyers to nearby Miami hotspots at a moment’s notice.

Get people in the door

And of course, having a high-tech sales center is meaningless if you can’t get people through the door to use it. At Princeton Classic Homes in Houston, sales manager Brett Briggs uses technology to target and interact with buyers before they ever get to his sales center door.

“During the high summer sales season, we’ll look to buyer-specific online outlets such as relocation websites—in Houston that’s the Houston Newcomer Guide—Facebook pages for key areas of town, Twitter, and educational institution sites,” Briggs says. “We look a lot to online portals and a targeted demographic methodology to reach buyers based on the inventory of product we have.”

Back to sales basics

A focus on the fundamentals is also apparent at single-family Bellmoore Park in Georgia. There, Mitch Levinson, managing partner of mRELEVANCE, which designed and implemented the community’s kiosks for the Providence Group, says simplicity, along with the human touch, should be the cornerstone of any technologically enhanced sales center, not an afterthought.

“Nothing will replace an effectively trained, skilled sales person,” says Levinson. “These are just tools to help them do their jobs, and they’re great at highlighting features, benefits, and the lifestyle of your community. But your sales people are still the ones who have to work with the customer.”

“Nothing will replace an effectively trained, skilled sales person,” says Levinson. “These are just tools to help them do their jobs, and they’re great at highlighting features, benefits, and the lifestyle of your community. But your sales people are still the ones who have to work with the customer.”

Levinson points out that when it comes to choosing those technology tools, it’s better to select ones people are already familiar with than to try to be on the cutting edge. “People respond better when common tools and techniques are used, like the Google maps tools we implement with Google locations, directions and ‘finger swiping’ tools,” Levinson says. “People are familiar with those before they get to the sales center and understand how to use them immediately. It is important to use technology that buyers already understand.”

In other words, whether it’s a tablet, kiosk or 15-foot-tall hologram, people have to connect with it. And when they do, sales are sure to follow.

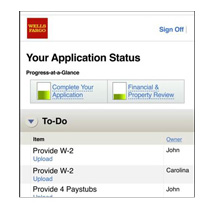

Digital access provides loan status clarity

With the ability to access loan information, receive alerts, and upload documents, your customers will have immediate application information with yourLoanTrackerSM.

Builders are becoming increasingly sophisticated about the technological tools they use in the home sales process. So it’s only natural for pros to choose a mortgage lender using the latest technology to make the home loan process more convenient.

Wells Fargo Home Mortgage’s yourLoanTracker includes a suite of features that helps your homebuyers engage in the mortgage process from their computer, smartphone, or tablet. It allows buyers to electronically submit required documentation and track the process of their loan application any day, at any time. It’s a better online experience for your customers.

To determine if a home loan is available with yourLoanTracker features, buyers should talk to a home mortgage consultant.

Experience the difference

The yourLoanTracker experience begins at application, when a Wells Fargo home mortgage consultant invites buyers to connect online. Customers are able to log into yourLoanTracker and access their own loan status.

The yourLoanTracker experience begins at application, when a Wells Fargo home mortgage consultant invites buyers to connect online. Customers are able to log into yourLoanTracker and access their own loan status.

eStatus. The eStatus dashboard makes buyers’ mortgage process clear and easy to track. The dashboard features a prominent “Progress-at-a-Glance” bar that provides a visual reminder of the milestones homebuyers have completed and the steps that are outstanding. The page also includes a link to the summary of the loan terms and a message box alerting the buyers to any new tasks. Buyers can navigate their loan status using three tabs:

- “Your Next Steps” provides a list of items or tasks organized by borrower. Each item includes a deadline that moves the process efficiently toward completion. When the task is completed, a green check mark will provide confirmation. Buyers can also verify where their documents are in the review process, from “In Process” to “Completed.”

- “Your Documents” is where buyers can see a list of all the documents they have submitted to Wells Fargo, whether electronically, by hand, by mail, or by fax. They can also see the documents Wells Fargo has sent to them electronically.

- “Wells Fargo’s Next Steps” shows “In Process” and “Completed Work” steps for Wells Fargo, such as “Obtain and Review Property Appraisal.”

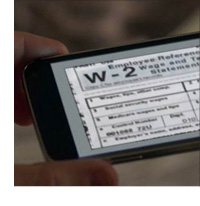

eUpload. It’s never been easier for buyers to submit the documents needed for their loan application. The eUpload feature allows them to upload documents from their laptop or simply snap a photo of them with their mobile device. The documents are automatically and safely placed in the borrower’s electronic loan file, and a “Success” message confirms the document was received.

eAlerts. Buyers can sign up to receive text message alerts for key milestones, such as disclosure available, conditional approval, appraisal received, final approval, final decision, and closing congratulations.

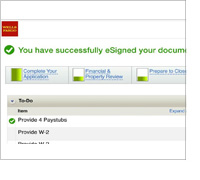

eDelivery. Buyers can speed up their mortgage decision timeline by choosing to receive electronic documents via eDelivery instead of paper documents. With eDelivery, buyers can immediately review and approve their Wells Fargo documents, eliminating the wait time for standard mail delivery.

eSignature - coming soon. In addition to eDelivery, Wells Fargo is working to make the disclosure process even more convenient. eSignature will allow homebuyers to electronically sign and approve select documents, eliminating the need to print, sign, and mail disclosures back to Wells Fargo.

While yourLoanTracker allows buyers to participate in the loan process online, they won’t be alone for the ride. Our home mortgage consultants play a critical, personalized role in helping your customers succeed financially, and they will continue to provide reassurance to homebuyers during the application process. By working with their local home mortgage consultant, builders can ensure their customers have an exceptional experience—so pros can get back to work building and selling better homes.

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2015 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801. #107569 Rev 5/15

This is an unsecured email service which is not intended for sending confidential or sensitive information. As a real estate agent, builder, accountant, financial planner, or other business contact you may be receiving invitations, product information, and various email communications. This may be a promotional email. To discontinue receiving promotional emails from Wells Fargo Bank N.A., including Wells Fargo Home Mortgage, please email NoEmailRequest@wellsfargo.com.

This information is for real estate and building professionals only and is not intended for distribution to consumers or other third parties.

Wells Fargo & Company Headquarters:420 Montgomery St.

San Francisco, CA 94104